Tuesday, October 4, 2011

Discount/Variety stores productivity

The table has the following columns:

1. Sales

2. YoY change in Sales

3. # of Stores

4. Average Store Size

5. Sales per Store

6. YoY change in Sales/Store

7. Sales per sqft

8. YoY change in Sales/sqft

So, which companies are doing good?

Total Sales is very much dependent on the number of stores and the size of the stores. YoY change in Sales would have been useful if there was information on the change in the number of stores, YoY.

Sales per store is again strongly associated with size of the store. But does bigger store size always mean higher sales?

Walmart has the biggest stores, with an average size of about 162,000 sqft. But Costco, with an average store size of 145,000 sqft has an impressive sales per store - $58 million more than a Walmart store. A Costco store is about 0.9 times the size of a Walmart store but its sales is 1.9 times that of a Walmart store.

Another interesting comparison is Target and Sam's Club. Almost the same store size, but sales at a Sam's Club store is almost twice that of a Target store.

You will see a very similar story if you use Sales per sqft instead of Sales per store. But what makes these analyses incomplete is the absence of average price/item. The comparison between Costco and Walmart is obvious - prices will be much lower at Walmart. But what about Target & Sam's Club? Prices at Sam's Club may still be lower but can that alone explain a Target store having twice the sales of a Sam's Club? Other factors that can be the reason behind a Target store's higher sales will be - optimized layouts (more efficient use of space, more items per unit area), higher traffic, larger proportion of high ticket items, etc..

And how are these companies growing?

Looks good - almost all of these companies are seeing positive trends in both total sales and sales per sqft, YoY. What about Kmart? Sales per sqft is growing YoY but total sales YoY is down. The first thing that comes to my mind - Kmart must have closed some of its non-performing stores. Any other reasons you can think of?

Wednesday, June 29, 2011

How to make an impact with Analytics

Sunday, June 5, 2011

Keep it simple

Is analytics all about actionable insights? Go and check out some of the websites of companies that offers analytics as a service. Chances are extremely high that you will come across either “actionable” or “actionable insights”.

But the truth is a lot of the work done at Analytics companies is not actionable at all. A lot of the daily or regular requirements will be the “good to know” numbers or information, or what many analysts will derogatorily refer to as Reporting work.

To be honest, when I just started my Analytics career I had the same biased or uninformed opinions. Predictive Analytics or Modeling was the only “cool” thing in Analytics. As they say, much water has flowed under the bridge and below are some of the things I have learned along the way, over the years.

All numbers and insights need not be actionable

When working with a new department or analyzing a new customer base, most of the analyses will start with understanding the business or the customers. The simple reports or the exploratory data analysis is going to be a very useful and important guide for future business plans and strategies.

If the results of your analysis can answer a business question, that’s good. And sometimes, it can be very good.

Averages are sometimes the best

I learned this all over again recently. The client wanted to see how different their 2 groups of customers were. As the initial discussion was focused on the purchase behavior or purchase life cycles of these two groups, I jumped into analyzing the customers’ monthly transactions since their acquisition dates - trying to see if these two groups have different buying patterns across their tenures.

When their overall sales didn’t throw up any surprises, I went into sales within specific product categories. By the end of the week, I found a few interesting patterns. But during the second meeting with the client next week, as I was going through the slides one by one (about 7-8 slides) – both my client and I realized that though the buying patterns were very similar, there was a big gap between the lines. Instead of analyzing how the behavior spiked or dipped or flattened out month on month, the biggest and most important analysis would have been a single slide on the averages of the two customer groups over their 1 year tenure. The differences in their average sales, basket size, number of trips, etc. was clearly seen – one single slide, one table – that was what I should have done when my hypothesis or what we all wanted to see was proved wrong by the data.

Understand the drivers – is modeling really required?

When clients say they want to understand the drivers of customer attrition or response, the first thing many analysts will do is to develop a model. But wait a minute, have some patience and ask a few more questions. A model has to be built if the client has a marketing plan or strategy because you will need to score customers for targeting.

What if all the client wants is to understand the drivers? Maybe all she needs is to identify and understand who these attriters or responders are. And to answer that, you don’t need to develop a model that will take a lot of time and money.

All you need is EDA. Means, frequencies and cross tabs based on the target variable (example, responded or not) will reveal things like – 70% of the responders visited the store in the last 3 months, 80% of the responders live within 5 miles of the store, 65% of the responders use a Credit Card, etc. And this will very much answer your client’s questions.

Signing off with:

Karma police, arrest this man

He talks in maths

He buzzes like a fridge

He's like a detuned radio

-- Karma Police by Radiohead

Wednesday, February 23, 2011

The Keyword Tree

Lately, I am getting very interested in data visualization and text mining. Just got the evaluation version of Tibco Spotfire and I would have to say this - it rocks! Beautiful high-quality visualizations, and a good number of features.

Was also playing around with the Keyword Tree from Juice Analytics. A brief description of this tool:

What search words and phrases are driving traffic to my site?

In the word tree visualization, you'll see a frequently used search term at the center. To the right and left, it shows the search terms that are most often used in combination with that word. The words are sized by their frequency of use and colored by bounce rate (or 0% new visitors or average time on site).

I then linked it to my Google Analytics account, and to this blog and here's what I got. Simply BEAUTIFUL!

Wednesday, February 9, 2011

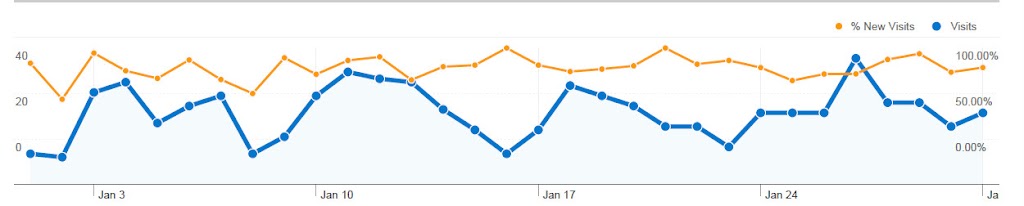

The Looking Glass

(Analysis time period: Jan 2011)

1. Visits vs % New Visits

2. Average time vs Pages/Visit

3. Where are you from?

In January, I have a lot of new visitors - a LOT :) The largest number of visitors/readers are from the US and India, but my readers from Russia seem to be the most ardent - almost 4 pages per visit. I cannot write "Thank you" in russian but google tells me how it sounds like. So to my readers from Russia - spasibo! :)